Car Insurance Average Premium for Liability Property Casualty Rates Usa

The average car insurance cost in the United States is $1,674 per year for full coverage, or about $139.50 per month, according to 2021 data pulled from Quadrant Information Services. Minimum coverage costs an average of $565 per year. These are national average rates for drivers with clean records. However, auto insurance premiums vary based on more than a dozen factors, according to the Insurance Information Institute (Triple-I), including your location, the type of vehicle you drive and your driving record, so you may pay more or less than the national average.

Some key facts about average auto insurance rates in 2021 include:

- If you have an at-fault accident, the average full coverage rate is $2,311 per year.

- If you have a DUI conviction, the average full coverage rate is $3,139 per year.

- Maine is the cheapest state for full coverage, with an average rate of $965 per year.

- USAA and Erie are the cheapest companies, on average, for full coverage, with annual rates of $1,225 and $1,233 respectively.

Bankrate's insurance editorial team analyzed car insurance rates by state, insurance carrier and vehicle manufacturer, as well as the driver's age, driving record, gender (where allowed) and other common rating factors. The car insurance prices provided here might help you understand how much your auto insurance policy could cost, which may be beneficial when looking for an auto insurer that fits your budget and coverage needs.

Key takeaways

- The national average cost of full coverage auto insurance in the U.S. is $1,674 a year or $139.50 per month.

- Americans spend about 2.44% of their household income on car insurance every year.

- Average car insurance rates are on the rise, increasing 5% between 2017 and 2018, the most recent years with available data.

- A speeding ticket will increase your annual full coverage car insurance premium by an average of 23%, an accident will increase it by about 38% and a DUI will increase it by approximately 87%.

How much does car insurance cost by state?

The answer to the question "How much does car insurance cost?" is a bit complicated. Numerous factors can impact how much you pay, including the state you live in. Even within a state, your ZIP code can influence your premium (except in California and Michigan). Auto insurance rates are affected by several local factors, including traffic volume, the likelihood of accidents and claims, and theft and vandalism rates in your area.

- Louisiana's full coverage rates are the most expensive in the nation, with an average price of $2,724 per year.

- Maine is the cheapest state for full coverage in the country, with an average annual premium of $965 per year.

- Louisiana and Florida have the highest average percentage of median household income spent on car insurance, at five percent and four percent.

- Hawaii and Massachusetts have the lowest average percentage of median household income spent on car insurance at just a little over one percent.

| Average cost of full coverage car insurance | |||

|---|---|---|---|

| State | Annual cost | Monthly cost | % of median household income spent |

| Alabama | $1,623 | $135 | 2.89% |

| Alaska | $1,559 | $130 | 1.99% |

| Arizona | $1,547 | $129 | 2.19% |

| Arkansas | $1,914 | $160 | 3.51% |

| California | $2,065 | $172 | 2.64% |

| Colorado | $2,016 | $168 | 2.78% |

| Connecticut | $1,845 | $154 | 2.11% |

| Delaware | $1,775 | $148 | 2.39% |

| Florida | $2,364 | $197 | 4.05% |

| Georgia | $1,982 | $165 | 3.50% |

| Hawaii | $1,127 | $94 | 1.28% |

| Idaho | $1,045 | $87 | 1.58% |

| Illinois | $1,485 | $124 | 2.00% |

| Indiana | $1,254 | $105 | 1.88% |

| Iowa | $1,260 | $105 | 1.91% |

| Kansas | $1,698 | $142 | 2.32% |

| Kentucky | $2,128 | $177 | 3.82% |

| Louisiana | $2,724 | $227 | 5.27% |

| Maine | $965 | $80 | 1.45% |

| Maryland | $1,877 | $156 | 1.96% |

| Massachusetts | $1,223 | $102 | 1.39% |

| Michigan | $2,309 | $192 | 3.60% |

| Minnesota | $1,643 | $137 | 2.02% |

| Mississippi | $1,782 | $149 | 3.98% |

| Missouri | $1,661 | $138 | 2.74% |

| Montana | $1,737 | $145 | 2.89% |

| Nebraska | $1,531 | $128 | 2.10% |

| Nevada | $2,245 | $187 | 3.17% |

| New Hampshire | $1,275 | $106 | 1.47% |

| New Jersey | $1,757 | $146 | 2.00% |

| New Mexico | $1,419 | $118 | 2.67% |

| New York | $2,321 | $193 | 3.23% |

| North Carolina | $1,325 | $110 | 2.17% |

| North Dakota | $1,264 | $105 | 1.80% |

| Ohio | $1,034 | $86 | 1.60% |

| Oklahoma | $1,873 | $156 | 3.15% |

| Oregon | $1,346 | $112 | 1.81% |

| Pennsylvania | $1,476 | $123 | 2.09% |

| Rhode Island | $2,018 | $168 | 2.88% |

| South Carolina | $1,512 | $126 | 2.44% |

| South Dakota | $1,642 | $137 | 2.56% |

| Tennessee | $1,338 | $112 | 2.36% |

| Texas | $1,823 | $152 | 2.70% |

| Utah | $1,306 | $109 | 1.55% |

| Vermont | $1,207 | $101 | 1.62% |

| Virginia | $1,304 | $109 | 1.60% |

| Washington | $1,176 | $98 | 1.43% |

| Washington, D.C. | $1,855 | $155 | 1.60% |

| West Virginia | $1,499 | $125 | 2.79% |

| Wisconsin | $1,186 | $99 | 1.76% |

| Wyoming | $1,495 | $125 | 2.30% |

What are the most expensive states for car insurance?

Louisiana has the highest average car insurance rates in the U.S. at $2,724 annually for full coverage or about $227 per month. Louisiana drivers also pay the highest percentage of their median household income toward car insurance, a whopping 5.27%. The other highest-cost states include Florida, New York, Michigan and Nevada.

| Average cost of full coverage car insurance | |||

|---|---|---|---|

| State | Annual cost | Monthly cost | % of median household income spent |

| Louisiana | $2,724 | $227 | 5.27% |

| Florida | $2,364 | $197 | 4.05% |

| New York | $2,321 | $193 | 3.23% |

| Michigan | $2,309 | $192 | 3.60% |

| Nevada | $2,245 | $187 | 3.17% |

What are the cheapest states for car insurance?

Maine has the lowest average rate for full coverage car insurance in the U.S., at $965 per year or about $80 per month, just 1.45% of residents' median household income. The other lowest-cost states are Ohio, Idaho, Hawaii and Washington.

| Average cost of full coverage car insurance | |||

|---|---|---|---|

| State | Annual cost | Monthly cost | % of median household income spent |

| Maine | $965 | $80 | 1.45% |

| Ohio | $1,034 | $86 | 1.60% |

| Idaho | $1,045 | $87 | 1.58% |

| Hawaii | $1,127 | $94 | 1.28% |

| Washington | $1,176 | $98 | 1.43% |

How much does car insurance cost by company?

Each auto insurance company has its own proprietary rating system, so the cost of car insurance varies from carrier to carrier. To find the best car insurance company for your needs, get quotes from different auto insurers to compare rates and features.

Below is a table showcasing the average annual and monthly premiums for some of the largest car insurance companies in the nation by market share. We've given each insurance company a Bankrate Score on a scale of 0.0 to 5.0. The Scores incorporate information about average prices, coverage offerings, discounts and third-party rankings. A higher Bankrate Score means the company scored higher in each rating category.

| Average cost of full coverage car insurance by car insurance company | |||

|---|---|---|---|

| Insurance provider | Bankrate Score | Annual cost | Monthly cost |

| Allstate | 4.0 | $1,921 | $160 |

| American Family | 4.3 | $1,911 | $159 |

| Amica | 4.5 | $1,378 | $115 |

| Auto-Owners | 4.5 | $1,351 | $113 |

| Erie | 4.6 | $1,233 | $103 |

| Farmers | 3.8 | $2,000 | $167 |

| Geico | 4.7 | $1,405 | $117 |

| The Hartford | 3.8 | $2,270 | $189 |

| Mercury | 4.2 | $1,558 | $130 |

| Nationwide | 4.4 | $1,485 | $124 |

| Progressive | 4.4 | $1,509 | $126 |

| State Farm | 4.7 | $1,457 | $121 |

| Travelers | 4.7 | $1,325 | $110 |

| USAA | 5.0 | $1,225 | $102 |

How much does car insurance cost by age and gender?

Age is typically one of the biggest factors for how much you will pay for auto insurance, with young drivers paying the highest premiums. Auto insurers use actuarial data to determine that teens and young drivers — as well as the elderly — are more likely to get in an accident, so the car insurance costs that these drivers pay are typically higher to compensate for the greater risk. Note that your age should not affect your premium if you live in Hawaii, as state regulations ban using age as an auto insurance rating factor.

Additionally, gender impacts your premium in most states. Men typically cost more to insure than women. Men generally engage in riskier driving behaviors than women and have a higher rate of accident severity, according to the Triple-I. However, not all states allow gender to be a factor in rates. If you live in California, Hawaii, Massachusetts, Michigan, Montana, North Carolina or Pennsylvania, your gender should not affect how much you pay for car insurance.

| Average annual full coverage car insurance premium by age and gender | ||||

|---|---|---|---|---|

| Male | Female | Difference | Percent difference between rates | |

| 18-year-old* | $5,646 | $4,839 | $807 | 14% |

| 25-year-old | $2,181 | $2,036 | $145 | 7% |

| 40-year-old | $1,648 | $1,701 | $53 | 3% |

| 60-year-old | $1,552 | $1,537 | $15 | 1% |

*18-year-old driver rate reflects renters (not homeowners) calculated on their own policy.

What you need to know about driving records

After a driving violation, you may be deemed a high-risk driver, and your premium could increase accordingly. The severity of your infraction and how many incidents you have on your driving record will impact how much your car insurance premium increases. For example, the average full coverage premium increases by over $1,400 per year after a DUI conviction but only by $388 annually for a speeding ticket.

How much does car insurance cost if I get a speeding ticket?

Speeding can increase the likelihood and severity of accidents. After a speeding ticket, full coverage car insurance rates increase an average of 23% annually.

| Average cost of full coverage car insurance with a speeding ticket | ||||

|---|---|---|---|---|

| Driving record | Annual premium | Monthly cost | Percentage above national average | Premium cost above national average |

| Clean driving record | $1,674 | $140 | 0% | $0 |

| Speeding ticket | $2,062 | $172 | 23% | $388 |

How much does car insurance cost if I get into an accident?

At-fault accidents can cause an insurance company to view you as more likely to cause an accident in the future. As a result, you'll pay about $637 more per year, on average, after causing a collision. Even not-at-fault losses might increase your premium. You could lose a claims-free discount, for example.

| Average cost of full coverage car insurance with an at-fault accident | ||||

|---|---|---|---|---|

| Driving record | Annual premium | Monthly cost | Percentage above national average | Premium cost above national average |

| Clean driving record | $1,674 | $140 | 0% | $0 |

| At-fault accident | $2,311 | $193 | 38% | $637 |

How much does car insurance cost if I get a DUI?

DUIs are among the most serious driving offenses. Being convicted of a DUI comes with numerous penalties, including increased insurance costs. You'll pay an average of 87% more for insurance if you have a DUI conviction on your driving record.

| Average cost of full coverage car insurance with a DUI conviction | ||||

|---|---|---|---|---|

| Driving record | Annual premium | Monthly cost | Percentage above national average | Premium cost above national average |

| Clean driving record | $1,674 | $140 | 0% | $0 |

| DUI conviction | $3,139 | $262 | 87% | $1,465 |

How much does car insurance cost by credit score?

Statistically, drivers with poor credit file more claims and have higher claim severity than drivers with good credit, according to the Triple-I. This means that, in general, the better your credit rating, the lower your premium. Your insurance credit tier is determined by each car insurance provider and is based on various factors; it probably won't exactly match the scores from Experian, TransUnion or Equifax as it is a credit-based insurance score, not a credit score. The table below showcases how credit can affect your annual full coverage car insurance premium.

California, Hawaii, Massachusetts, Michigan and the state of Washington do not allow credit to be factored in when setting auto insurance rates.

| Average cost of full coverage car insurance by credit score | ||||

|---|---|---|---|---|

| Poor | Average | Good | Excellent | |

| National average | $3,873 | $1,865 | $1,674 | $1,487 |

How much does car insurance cost by vehicle type?

The type of vehicle you drive has a significant impact on your car insurance premium. The price and availability of parts, cost of labor, statistical likelihood of accidents and the vehicle's safety and crash prevention features could all influence how much you pay for coverage. The vehicle makes and models in the table below are the five most popular vehicles in the country.

| Average cost of full coverage car insurance by make and model | ||||

|---|---|---|---|---|

| Sales ranking | Make and model | Annual cost | Monthly cost | |

| 1 | Ford F-150 | $1,442 | $120 | |

| 2 | Chevrolet Silverado | $1,682 | $140 | |

| 3 | Ram 1500 | $1,697 | $141 | |

| 4 | Toyota RAV4 | $1,510 | $126 | |

| 5 | Honda CR-V | $1,369 | $114 | |

How much does car insurance cost for a beginner?

Teenage drivers have crash rates that are almost four times higher than more experienced drivers. To compensate for this risk, car insurance companies typically charge more for teen drivers. In fact, teens are one of the most expensive groups to insure.

| Average annual full coverage car insurance premium for 16-year-old drivers | |||

|---|---|---|---|

| Average annual full coverage premium | Percentage above national average | ||

| National average | $1,674 | 0% | |

| 16-year-old* | $2,531 | 51% | |

*16-year-old rate reflects the premium increase for adding the teen driver to their parents' auto policy.

Additional factors that affect car insurance rates

In addition to your state requirements, vehicle type, age (except in Hawaii), driving record and gender (in most states), several other rating factors will impact your auto insurance premium.

Coverage selections

Your car insurance coverage options have a significant effect on your rate. If you select higher liability limits, choose lower deductible levels or take advantage of endorsements, your rates will likely be higher.

Insurance history

If you've had continuous car insurance for the length of time you've been licensed and owned a car, you may pay lower rates. Lapses in your insurance history (unless you did not own a car during that time) can be an indication of high-risk behavior and can increase your premium.

Annual mileage

The more you drive, the more likely you are to get into an accident. Policyholders who drive fewer than 5,000 miles a year often qualify for lower rates (although this mileage designation varies by company).

How to find the best car insurance rates

Buying car insurance doesn't have to mean breaking the bank; there are ways to save. Discounts are one of the best ways to lower your premium. Most major car insurance carriers offer discounts. Here are some of the most common insurance discounts in the U.S.:

- Claims-free: Drivers who have no auto claims on their record for the past several years typically qualify for savings.

- Bundling insurance policies: You can often reduce your auto insurance premium when you bundle your car insurance policy with a home insurance policy, earning discounts on both policies.

- Good student discounts: Many auto insurers offer discounts for young drivers who earn good grades in school.Paying in full: If you can afford to pay your car insurance premium in full, versus monthly or quarterly, you may reduce your premium.

- Telematics: Most car insurance companies offer telematics programs where you can allow them to track your driving habits with an app or device for savings.

Because every auto insurer offers a different suite of discounts, speaking with your insurance agent or company representative may be the best way to learn about savings opportunities.

Additionally, getting quotes from several car insurance companies can help you compare rates. Each company sets its own rates, so the same coverage can cost vastly different amounts with different providers. Comparing quotes might help you find the lowest price for the coverage you need.

Frequently asked questions about car insurance costs

Is full coverage insurance worth it?

Full coverage car insurance means you add coverage for damage to your vehicle by adding comprehensive coverage and collision coverage. In many circumstances, full coverage car insurance may be worth it. It is typically more expensive than minimum coverage, but it can help you pay for the cost of your vehicle repairs or replacement after a covered loss. Full coverage can be required if your car is financed or leased.

Does your car insurance go down after your car is paid off?

It might, but only if you change your coverage selections. Financing a vehicle doesn't directly impact your car insurance premiums, but your lender likely requires you to carry full coverage, which can increase the price you pay. Once you pay off your loan, you could remove full coverage and have a liability-only policy, which would likely reduce your premium. However, you might want to talk to your agent first. Full coverage can be a good idea even if you own your car outright.

Is it cheaper to pay car insurance every six months?

Whether or not it's cheaper to pay your car insurance in full every six months depends on your insurance company. Auto insurance policies typically operate on an annual or six-month term, and there is no guarantee that a six-month policy will be cheaper than an annual one. Whether or not you choose an annual or six-month policy, many insurance providers offer discounts for paying in full. You may want to check with your insurance agent to see what kind of savings come with paying for your policy in full rather than in installments.

Does car insurance decrease every year?

Car insurance rates, on average, steadily decrease as you age, until about the age of 70, when they slowly begin to increase again. However, your car insurance may not decrease every year, since car insurance rates are based on several factors, including your geographic location, vehicle make and model and driving history. If you've been involved in an accident or been charged with a DUI, you may see major premium increases when you renew your policy. Even if your personal characteristics and policy details don't change, your premium may increase. Insurers file new rates with the departments of insurance in the states they serve every year, so your premium may be subject to increases or decreases that reflect these new rates.

Methodology

Bankrate utilizes Quadrant Information Services to analyze 2021 rates for all ZIP codes and carriers in all 50 states and Washington, D.C. Quoted rates are based on a 40-year-old male and female driver with a clean driving record, good credit and the following full coverage limits:

- $100,000 bodily injury liability per person

- $300,000 bodily injury liability per accident

- $50,000 property damage liability per accident

- $100,000 uninsured motorist bodily injury per person

- $300,000 uninsured motorist bodily injury per accident

- $500 collision deductible

- $500 comprehensive deductible

To determine minimum coverage limits, Bankrate used minimum coverage that meets each state's requirements. Our base profile drivers own a 2019 Toyota Camry, commute five days a week and drive 12,000 miles annually.

These are sample rates and should only be used for comparative purposes.

Age:

*2021 rates for 16-year-old are based on a driver of this age added to their parents' policy.

*2021 rates for 18-year-old are based on a driver of this age that is a renter (not a homeowner).

Model: To determine the cost by vehicle type, we evaluated our base profile with the following vehicles applied: Ford F-150, Chevrolet Silverado, Ram 1500, Toyota RAV4, Honda CR-V and Toyota Camry (base).

Incidents: Rates were calculated by evaluating our base profile with the following incidents applied: clean record (base), at-fault accident, single speeding ticket, single DUI conviction and lapse in coverage.

Gender: The following states do not use gender as a determining factor in calculating premiums: California, Hawaii, Massachusetts, Michigan, Montana, North Carolina, Pennsylvania.

Credit-Based Insurance Scores: Rates were calculated based on the following insurance credit tiers assigned to our drivers: "poor, average, good (base) and excellent." Insurance credit tiers factor in your official credit scores but are not dependent on that variable alone. Five states prohibit using credit-based insurance scores as a rating factor in determining auto insurance rates: California, Hawaii, Massachusetts, Michigan and Washington.

Bankrate Scores

Bankrate Scores primarily reflect a weighted rank of industry-standard ratings for financial strength and customer experience in addition to analysis of quoted annual premiums from Quadrant Information Services, spanning all 50 states and Washington, D.C. We know it is important for drivers to be confident their financial protection covers the likeliest risks, is priced competitively and is provided by a financially-sound company with a history of positive customer support.

To determine how well the best car insurance companies satisfy these priorities, third-party agency ratings from J.D. Power, AM Best, S&P, NAIC, and Moodys had the most impact on the companies' Bankrate Scores. As price is a common consideration for drivers, we analyzed quoted premiums based on 40-year-old male and female drivers with a 2019 Toyota Camry. This profile, assessed across more than 35,000 ZIP codes in the U.S., provided a basis on which drivers may compare each provider.

While coverage options, insurer availability, affordability and customer experience are often the top priorities, Bankrate also analyzed each insurer's online and mobile resources for policy management and claims handling. Insurance is rapidly evolving to keep pace with our digital world, so these aspects also carried weight in determining Bankrate Scores.

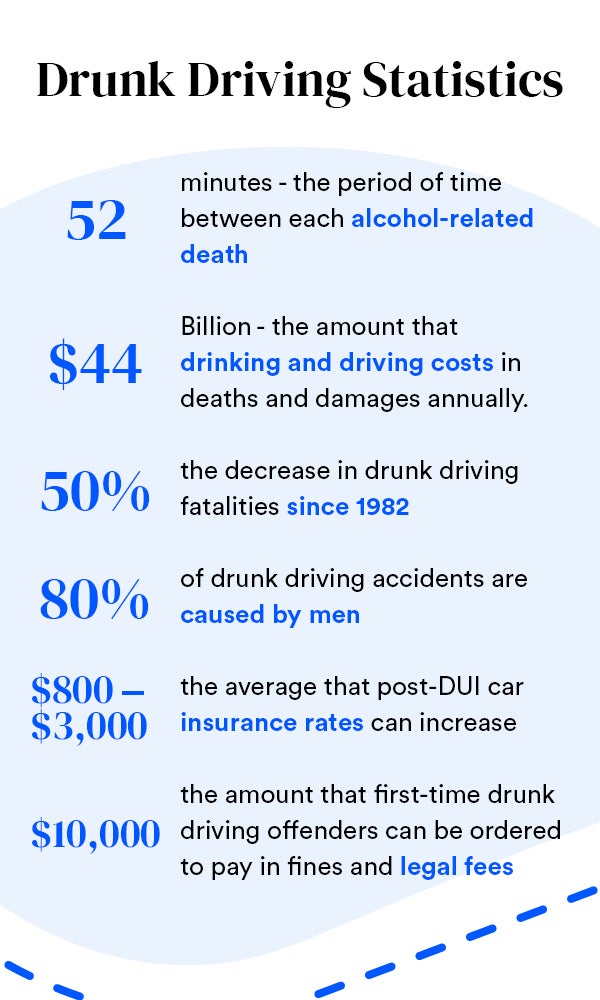

Drunk Driving Statistics

Drinking and driving kills more than 10,000 people each year, though that number has decreased in recent years. Alcohol-related traffic fatalities make up just under 30% of all traffic fatalities.

Fast Facts

How to Prevent Drunk Driving

Public attitude continues to shift as more and more families are touched by the negative consequences of drinking and driving. Today, there is significantly more educational information and more laws than ever before, all designed to help new generations of drivers understand the rules and risks of the road.

Here are some additional things you can do…

- Talk to your kids.

- Use rideshare.

- Hop on a scooter.

- Spend the night.

- Plan ahead.

- Don't drink and drive.

Additional Resources

Drunk Driving Statistics

Most Dangerous Days to Drive

Cost of a DUI

Drowsy Driving Facts

Whatever it takes, make sure you do not drive drunk or even buzzed. Give your keys to a sober friend and find a designated driver or call a safe ride.

Car Insurance Average Premium for Liability Property Casualty Rates Usa

Source: https://www.bankrate.com/insurance/car/average-cost-of-car-insurance/